In spite of the so-called Great Resignation, wages haven’t risen as dramatically as some economists anticipated. About 41% of workers recently surveyed by Willis Towers Watson say that they’re living paycheck to paycheck, while the Bureau of Economic Advisers reports that personal savings rates reached a seven-year low in April — reflecting the dire financial situation many workers find themselves in.

Tate Hackert, the CEO of Calgary-based ZayZoon, asserts inflexible pay schedules are a major contributor to the inequity. That’s one of the reasons he founded ZayZoon, he says — so that workers can access pay when bills come due rather than on a fixed schedule.

To grow the business, ZayZoon today closed a $12.5 million funding round co-led by Carpe Diem Investments and Alpenglow Capital with participation from InterGen Capital, Prairie Merchant Corporation, and several angel investors. Alongside a $13 million loan from ATB Financial, the proceeds bring ZayZoon’s total raised capital to date to $25 million.

“Saving every penny I made, at the age of 16, I provided mortgage financing to a family friend in return for interest payments,” Hackert told TechCrunch in an email interview. “The same patterns emerged — people with relatively [good] incomes that needed a small amount of capital for a small amount of time just to get by … I sought out to create a product that could help employees in their most vulnerable moments, while staying socially responsible and true to a mission of improving their overall financial health.”

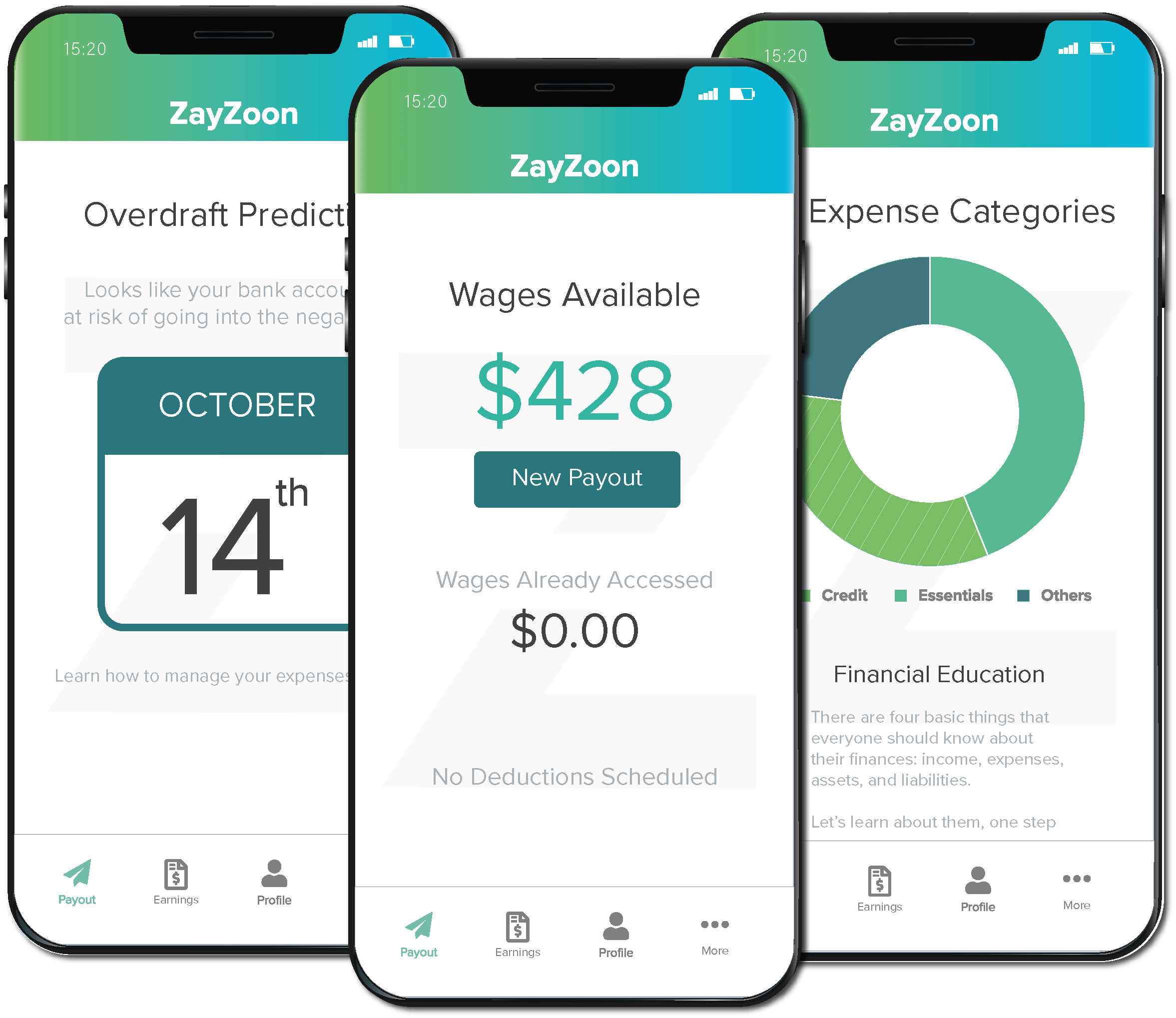

ZayZoon’s platform allows small- and medium-sized businesses to implement what’s known as an earned wage access (EWA) program. EWA gives employees access to some of their accrued wages before the end of their payroll cycle. Workers still receive the entirety of their paycheck at the end of each cycle. However, the advancements made are subtracted from the direct deposit account.

ZayZoon funds early wage requests itself to mitigate risk on the employer side. The service is free for companies to use, but ZayZoon charges workers a $5 fee to choose how much of their wages they’d like to access (up to $200). Companies can opt — but aren’t required — to subsidize the benefit.

Funding requests are disbursed “within minutes” to employees’ accounts, or workers can sign up for a ZayZoon-branded Visa card that acts like a prepaid debit card. Whether or not they decide to go the prepaid route, workers can link ZayZoon to their bank accounts for spending insights in addition to alerts of overdraft and minimum account balance fees.

“Employers assume implementing an EWA program takes immense effort, but ZayZoon can fully activate a business in less than 1 hour, with the majority taking less than a few minutes,” Hackert said. “Over 3,000 businesses offer ZayZoon to their staff today … Depending on the industry and employee demographics, it’s typical for a business that rolls out ZayZoon to have 25% to 45% of their workforce accessing ZayZoon regularly.”

ZayZoon claims that Sonic, McDonald’s, Domino’s, and Hilton franchisees are among its customers.

ZayZoon is a part of a massive industry, to be sure, with research firm Aite-Novarica Group estimating that EWA providers moved about $9.5 billion in pay in 2020. India’s Refyne raised $82 million to do so in January, while platforms like Branch, DailyPay, and Even have secured hundreds of millions of dollars for their EWA services.

But in spite of VC cash and endorsements from big-name brands like Uber, Lyft, and Walmart, EWA is under increased scrutiny from regulators, including the U.S. Consumer Financial Protection Bureau (CFPB) and the California Department of Financial Protection and Innovation. For example, in New Jersey, recently enacted rules mandate that EWA providers confirm a customer’s earned income before sending them an advance and get an employee’s consent before getting information about workers from employers.

Image Credits: ZayZoon

Some consumer groups argue that EWA programs should be classified as loans under the U.S. Truth in Lending Act, which provides protections such as requiring lenders to give advance notice before increasing certain charges. The groups argue that some EWA programs can force users into overdraft while effectively charging interest through fees.

A $5 per-pay-period fee might not sound like very much, but it can add up, especially for a low-income worker — and the consequences can be disastrous. Just $100 fewer in savings can make families more likely to pursue predatory lending and forgo utility bill payments, one 2020 study showed; an estimated one in five families in the U.S. has less than two weeks of liquid savings.

Hackert takes pains to distance ZayZoon from “predatory” EWA programs, positioning it instead as a welcome alternative to late bill payments, overdraft fees, and payday loans. Users aren’t under a legal obligation to repay ZayZoon and ZayZoon won’t take action to collect payments, but nonpaying users will be limited from accessing the service in the future. At the same time, Hackert suggests ZayZoon can protect businesses — particularly smaller, independent businesses — from employees who’d otherwise steal from the cash register to make ends meet.

“ZayZoon is special in the competitive landscape because we specifically cater to small- and medium-sized businesses,” Hackert said. “ZayZoon specifically sought out to service the underserved … Financial stress is a major contributor to lost productivity and health issues.”

It remains unclear whether EWA programs are a net positive for companies, however. Taking Walmart as an example, the retail giant had high hopes of boosting retention by giving employees access to earned wages early. Instead, it found that employees using the early wage access service tended to quit faster.

It’s not just businesses that could have grievances. Some workers might object to the ways ZayZoon shares their personal information. For instance, the company has a partnership with Prizeout to run ZayZoon Boost, an optional service that pays out wages in the form of gas, grocery, and retail gift cards. ZayZoon advertises Boost as a way to earn gift cards worth more than early wage payouts. But in its privacy policy, ZayZoon makes clear that users participating in Boost agree to transfer personal and financial information to Prizeout, including their name, date of birth, gender, and address.

Beyond Boost, ZayZoon retains the right to use any user’s data to conduct research, contests, surveys, and sweepstakes and use it for marketing and promotions. Hackert notes that workers can email ZayZoon’s customer support to request their data be deleted, but there isn’t an in-app mechanism to make this easy.

“Businesses care about ZayZoon because we greatly improve their employee well-being, productivity, retention, and recruitment efforts,” Hackert said. “ZayZoon actively seeks to collaborate in [regulatory] efforts and is supportive of well-considered regulation, as ambiguity is never a good thing. There are market entrants who unfortunately take advantage of this ambiguity at the expense of the consumer — charging high fees, operating in ways that aren’t transparent, and imposing on a consumer’s data privacy.”

With the proceeds from the equity and debt round, ZayZoon plans to invest in general product development and market expansion. When asked whether ZayZoon plans to hire in light of the global economic slowdown, Hackert replied in the affirmative, saying that he aims to grow the headcount from 60 employees to 85 by the end of the year.

via Tech News Digest

No comments:

Post a Comment